Mexico. The subscription video streaming market in Mexico is in a mature phase in which the rate of growth in the number of subscriptions has slowed down and there are structural barriers to attracting new users, such as the lack of resources to create or maintain one or more accounts, the diversification of hybrid or ad-supported platforms, and persistent disconnection from the internet.

At the same time, a rebalancing of market share has been triggered towards competing players to the incumbent/main player, Netflix. This, based on its offer of increasingly relevant content, its incursion into the transmission of live sports matches, the bundling with telecommunications services and other platforms, as well as derived from its competitiveness in terms of tariffs.

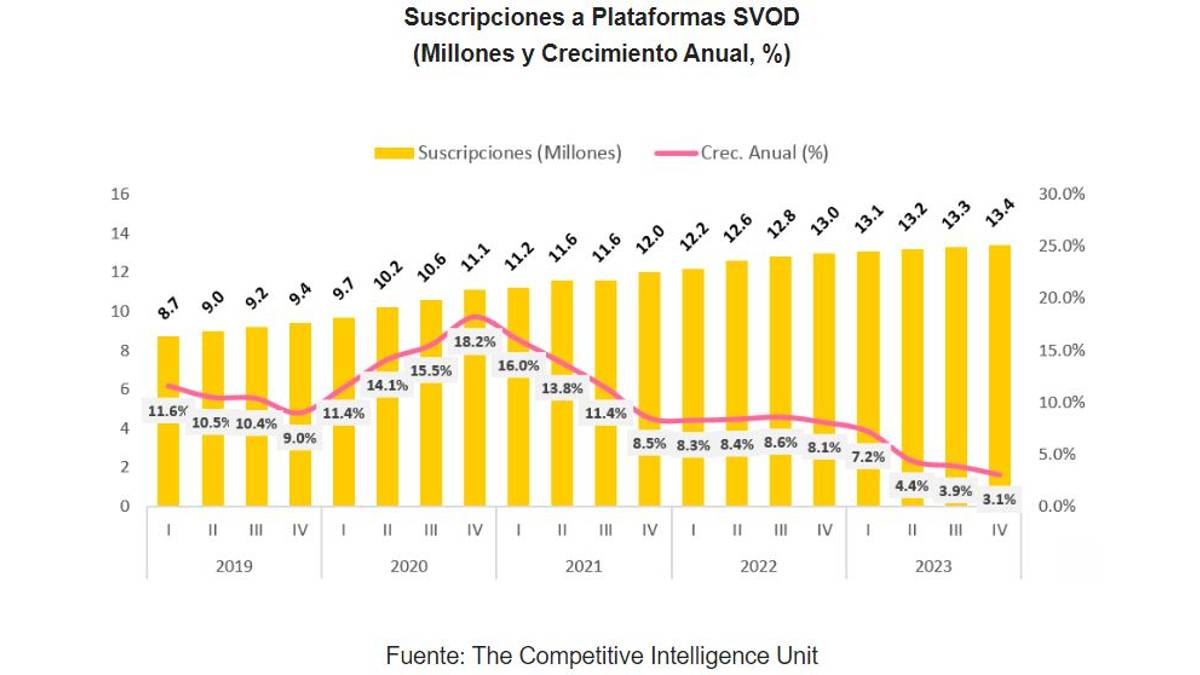

SVOD Platform Subscriptions

According to information from the study "Consumption and Contracting of Video On Demand Services 4Q-2023", prepared by The Competitive Intelligence Unit (The CIU), the number of subscriptions to subscription video on demand platforms (Subscription Video On Demand or SVOD) in Mexico amounted to 13.4 million at the end of 2023, 3.1% more in its annual comparison. This implies a significant slowdown, to less than half of the growth recorded a year ago (8.1%).

This accounting enables the consumption of content by 43 million Internet users in our country, a figure equivalent to a ratio of 45% of the total, as they are users who pay (31% of the total) or share an account (69%). It is precisely this last proportion that has registered a boost in the last six months, as a result of the tariff increase and budget restrictions that make it impossible to have all the platforms and encourage account sharing.

The maturation of this market, and the aforementioned structural barriers it faces, has resulted in a decrease in the proportion of users who would contract or pay for one of these alternatives for access to audiovisual content in the next six months. This only stands at 4% at the end of 2023, while in the second quarter of 2023 (Q2-2023) it was double (8%).

Platform Market Share

In terms of market share, the main player Netflix continues on a downward ramp, approaching half (53.0%) of total subscriptions, as of the fourth quarter of 2023 (Q4-2023), this is 4.9 percentage points (pp) less than six months ago.

This platform, which is positioned among the ones with the highest monthly cost, with frequent increases in its prices in recent years and the imposition of locks on account sharing, has reduced its market share, despite adding value to users, for example, from the addition of video games, and launching a lower-cost plan with advertising.

Among the players that have gained ground, ViX+ stands out, quadrupling its market share in the last six months, going from 1.8% in Q2-2023 to 7.0% in Q4-2023.

Vix+ has increased its relevance as a result of the broadcast of Liga MX matches, the offer of reality shows, the launch of biographical series, and of course, by being a repository of a robust aggregate of television and film productions in Spanish, both recently released and historical.

Another platform with significant growth in preference is Paramount+, increasing its market share by +1.8 pp, reaching 2.3%, from the broadcast of Premier League matches that have encouraged its contracting and preference, but also derived from the competitive determination of rates, discount on its annual plans and offer packaged with telecommunications services. as in the case of ViX+.

On the other hand, Disney+ (13.5% of total subscriptions), HBO Max (11.8%) and Amazon Prime Video (7.6%) have managed to strengthen their market positioning based on the offer of attractive content for audiences, promotions in the price of their subscription, bundling with telecommunications services and other platforms, as well as the transmission of live sporting events.

The rest of the platforms available in Mexico, such as Star+, Apple TV+, Claro Video, Mubi, among others, together accumulate a market share of 4.7% of total subscriptions. Some of these are in the search to consolidate themselves as relevant players in the coming periods, with the addition of more content, mergers and acquisitions of new licenses and offers of greater added value.

All in all, this market has left behind the phase of accelerated expansion and the 'bubble' in hiring brought about by the pandemic, to face less dynamism and a slowdown in its growth, as there are structural barriers and intensified competition between alternatives for access to audiovisual content.

However, there has been a market rebalancing in favor of platforms other than the incumbent/main Netflix, which places players such as ViX+ in the first places in terms of preference, due to the growing relevance of its catalog and offer for audiences, the affordability of its rates and the manifest muscle in the generation of live audiovisual content and in Spanish.

Analysis by Radamés Camargo of The Competitive Intelligence Unit, The CIU.

Leave your comment