Mexico. According to the latest report by The Competitive Intelligence Unit, restricted television has traditionally been one of the main means of access to audiovisual entertainment and information content in Latin America. Although in recent years technological evolution has expanded the menu of consumption alternatives, pay television maintains a relevant weight among the preferences and spending profile of Latin Americans.

Mexico. According to the latest report by The Competitive Intelligence Unit, restricted television has traditionally been one of the main means of access to audiovisual entertainment and information content in Latin America. Although in recent years technological evolution has expanded the menu of consumption alternatives, pay television maintains a relevant weight among the preferences and spending profile of Latin Americans.

At the end of 2016, the Pay-TV markets in Latin America registered a cumulative accounting of more than 74 thousand subscriptions, which implies that currently more than 55% of households in the region have access to this service. Among the countries that accumulate the largest number of subscribers are Brazil, Mexico, Argentina, Colombia, Chile, Peru and Ecuador. These concentrate a proportion of 89.6% of total subscriptions in Latin America.

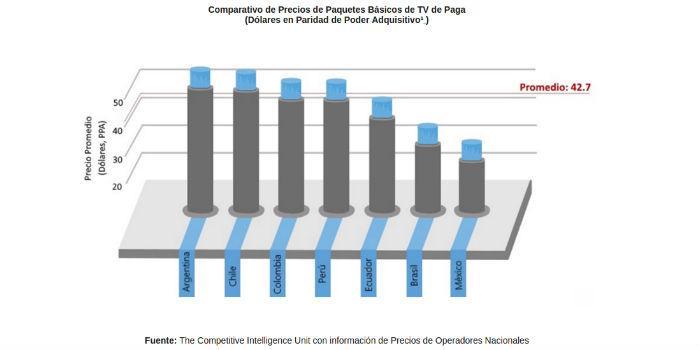

In the region, the restricted television service identifies a significant price differential between countries. This differential responds both to cost schemes, on the side of the operators, and to inherent characteristics of the market (level of competition, degree of development of convergent networks, among others) and consumer preferences. Additionally, some packages in certain countries may include content exclusively available on restricted television that in others are offered on free-to-air television. This may be the case for sports content.

These packages that include this type of content are more attractive to end consumers, so in their absence on open television the incentives for hiring pay TV are detonated. The packaging of services (double and triple play) is another factor that pushes up the adoption of the service, due to the savings generated for both operators and end consumers.

Next, the differences in prices and affordability of basic pay-TV packages in the referred markets are analyzed in three dimensions. First, the simple price comparison makes it possible to identify the differences in a general way between the service offers by country. At a second level, the offer of basic packages is analyzed by contrasting with the content included (by the number of channels), in such a way that a clear relationship is established on the cost per content contracted. Finally, in the third and final section, the affordability for potential users by country is analyzed, reflected in the expenditure related to per capita income or average per capita income.

Comparison of Prices of Basic Packages

The prices presented here are obtained with the average monthly value of the basic packages offered by country of the main pay-TV operators in force for the first quarter of 2017 (1Q17). In each case, the lowest price packages of the individualized service were used, that is, excluding packaged offers, and without distinction between payment methods (prepaid or postpaid). Monthly prices do not include installation costs, equipment fees or promotions.

In absolute terms, the prices of basic packages in Mexico, Brazil and Ecuador are the cheapest. In Argentina, the average price of these packages is the highest in the region, equal to $52.5 (PPP) in 1Q17. In contrast, Mexico offers the most affordable basic service in the region at less than half ($26.3, PPP) of the price than in Argentina.

Despite the high prices in Argentina and Chile, the largest number of average channels per basic package is offered compared to the rest of the countries.

For a more detailed analysis it is necessary to take into account the differences in channels and services offered between the basic packages by each country. In this way, it is possible to contrast the real expenditure incurred by consumers.

Price / Content Ratio Offered

The Price/Content ratio (P/C) indicates the number of channels (in standard quality or high definition) that are purchased at the established price. In this way, a person in a country with a higher P/C ratio to the rest will be paying more for a smaller amount of content.

This is the case in Argentina, where the P/C ratio in basic restricted television packages is higher than in any other country shown in the graph above. In this country the basic supply of pay TV is the most expensive in relative terms, because the average number of channels offered (82) is lower than the average between countries (83), but at higher prices.

Offers in Mexico and Brazil have the lowest average price level for contracted content. Additionally, packages from Colombia and Chile are more attractive than those from Peru in their Price/Content ratio despite their higher prices. This is due to the offer of channels included in the packages of the main operators. In these cases, the greater number of channels offered more than compensates for the difference in prices.

Pay-TV affordability

The decision to contract the service depends to a large extent on the proportion that this expense will represent of the income of the potential user, due to its price level. The graph below illustrates the average proportion that individuals would spend annually on their income to purchase restricted television packages by country. Measured through the ratio between the annualized price level of basic packages and GDP per capita in each country.

In Mexico, the lowest proportion of income (1.6%) is allocated to the hiring of Pay-TV. On the contrary, Ecuador reaches the highest proportion (4.4%) due to the price level, while the average proportion of expenditure in the countries analyzed reaches 3.2%. In the latter case, despite the fact that Ecuador is not the most expensive country, in terms of prices, the restricted television service is the least affordable in income of individuals.

In Mexico, the offers of satellite services introduced just over 5 years ago have allowed consumers of medium and low socioeconomic levels to allocate a smaller proportion of their income to the service and, therefore, subscriptions to the service were triggered. These offers have permeated among the households of this population segment by becoming affordable.

It is important to note that higher pay TV prices do not necessarily imply a higher expense with respect to the average income level. For example, in Argentina, despite high prices and fewer channels offered, the ratio of spending to per capita income is just below the average level. Chile identifies a similar situation to Argentina, however, it is the country with the second lowest proportion of income destined for the service just after Mexico.

Price analysis is essential to understand the levels of adoption reached by the markets considered. The three dimensions analyzed refer to the different factors that combine to define the degree of affordability and levels of contracting of restricted television packages in the main markets of Latin America. On the one hand, the comparison in prices expressed in PPP registers substantial differences between countries such as Argentina and Mexico.

Second, the inclusion of more content is offset by higher prices. However, price/content ratios allow countries with cheaper packages to be more clearly identified in relation to the content offered. Finally, the affordability of the service, in terms of expenditure as a proportion of GDP per capita, shows significant changes with respect to the initial comparison. Although Mexico remains the country with the lowest prices at all levels of analysis, in Ecuador and Peru the service is less affordable than it might seem in the initial price comparisons.

Report by Javier Medina and Santiago Yunez of The Competitive Intelligence Unit.

Leave your comment