Despite the growing offer and preference for streaming platforms, traditional linear television continues to be an essential part of people's lives in Mexico.

Ernesto Piedras*

Today, the audiovisual content ecosystem has a growing number of players, a diversification of preferences and consumption habits. This is how different actors, platforms and access technologies coexist and compete, but with some differences regarding the scope, availability, reliability, effectiveness, quality and speed in the delivery of the transmitted content.

Precisely, in this market, open television remains the main means of access to audiovisual content, due to its greater access, coverage, affordability, among other factors that favor its access.

Meanwhile, digital content platforms (YouTube, Netflix, Disney+, among others) register an accelerated preference directly linked to the growing adoption of the internet, but they face barriers to availability of connectivity, purchasing power, capacity and download speed of content, especially in rural regions, with lower spending, poor coverage and development of telecommunications services.

Audience numbers for Free-to-Air TV and digital platforms

The 2022 National Survey of Audiovisual Content Consumption (ENCCA) conducted by the Federal Institute of Telecommunications (IFT) indicates that 94.4 million Mexicans or 88% of the population aged 7 or over in the country with a television, consume broadcast television content, either through open or pay TV signals.

Likewise, consumers of open television do not only do so in a traditional way, but can also access it through digital media, such that 6 million Mexicans watch TV broadcast through the Internet.

Despite the growing offer and preference for streaming platforms, traditional linear television continues to be an essential part of people's lives in Mexico.

The greater availability of broadcast TV infrastructure, even in remote and lagging places, its affordability and free access without the need for an internet connection, as well as the live transmission of a multiplicity of content (news, sports, variety shows, reality shows, among others), place this traditional audiovisual medium at the forefront in terms of audience.

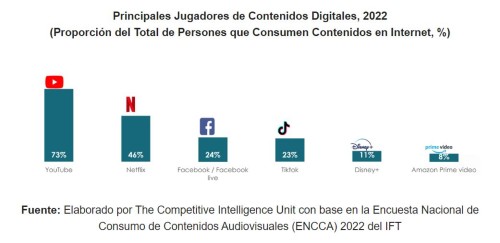

Certainly, online platforms have gained ground in preferences, as they have attributes such as ubiquity, ease of access to on-demand content, multi-device offer, among others. Just over half of the population aged seven and over (53%) choose to consume content online, with YouTube being the main platform for access.

Traditional vs. Digital Media Leadership

In Mexico, the audience of digital platforms tends to favor alternatives to access free audiovisual content, that is, without additional costs to the internet connection, as is the case of YouTube.

Despite being the preferred player, this platform barely has a reach of less than half (44.3%) of the total registered by broadcast TV, accounting for 41.8 million users compared to the 94.4 million people with televisions who watch open TV channels, according to official information from the ENCCA. This figure from the IFT survey indicates that YouTube's true reach is well below the 65 million people that this platform announced in recent days.

On the other hand, only 8.2% (3.4 million) of the total users make a monthly payment on this platform, the vast majority (91.8% or 38.4 million) access content for free. Audiences are willing to pay for original, exclusive, higher-quality content with a better user experience, available on the offer of players such as Netflix or Amazon Prime Video.

In addition, the differences in consumption habits between the two means of access are remarkable. On average, people spend 2.5 hours a day watching broadcast TV versus just 1.2 hours a day exploring YouTube's offerings.

Barriers to Digital Content Consumption: Access to Connectivity

Barriers to Digital Content Consumption: Access to Connectivity

An essential link for access to the content offer on digital platforms is the availability of a permanent and sufficient internet connection.

According to the IFT, as of the first quarter of 2023 (Q1-2023), 21.95 million residential fixed broadband accesses were registered in the country, a figure that enables internet access to 60.6% of households. The rest would be able to access content via mobile technology, a circumstance that would restrict the number and days of browsing, as they have a limited supply of data, especially in the prepaid segment.

As of the second quarter of 2023 (Q2-2023), there were 118.0 million prepaid lines, 82.5% of the total in the country. This statistic reveals the marked preference for this payment method, which offers aggressive rates, flexibility and control in spending.

This market sub-segment represents a significant portion of the Mexican population, with limitations in the amount of mobile data and access to streaming platforms influencing their preference for entertainment media. Some of these barriers include:

1. Data Limits and Validity

Despite the widespread adoption of prepaid lines in Mexico, 6 out of 10 users recharge $100 pesos or less, which translates into a relatively low average monthly user spend of just $90 pesos.

With this level of consumption of mobile services, connectivity could only be available for 14 days. This circumstance presents a significant challenge for the consumption of digital content, since prepaid users in Mexico would be disconnected for approximately half of the month.

Additionally, this monthly expense enables an average consumption of 1.5 GB in data, an insufficient amount for access to video content, considering that viewing on YouTube can discount up to 60 megabytes per minute in the highest quality. Despite the fact that some operators include unlimited consumption of YouTube in their largest recharges, most continue to focus only on offering social networks and instant messaging.

2. Connection Speed

Often, mobile prepaid plans offer slower connection speeds compared to postpaid and fixed broadband accesses. This can make the streaming experience on video platforms poor, leading users to opt for other audiovisual media such as free-to-air TV.

These elements make it clear that digital platforms require a robust and abundant internet subscription in order to have access to their offered content. The gap in internet access in homes, the limited connectivity capacities under the prepaid modality and the low consumption of mobile services are conditions that explain the preference for open TV among Mexicans.

Preference for advertising in traditional media

The persistent digital divide and limited connectivity capabilities for prepaid mobile users in Mexico also explain the preference for open television for advertising brands, products and services. The following are some of the key reasons behind this predilection:

1. Greater Reach

Free-to-air television reaches a wider audience in Mexico than internet video platforms. This is due to its availability in rural areas, its affordability for people with fewer resources, and the reliability of content streaming.

2. Local Advertising

Free-to-air TV continues to be an effective platform for delivering advertising from local advertisers, allowing these companies to target specific audiences in certain geographic regions, something that digital platforms cannot yet match.

3. Diverse Audience

Free-to-air television attracts a diverse audience in terms of ages, interests, and demographic profiles. This makes it an attractive medium for advertisers looking to reach a wide variety of consumers.

All these conditions explain the predilection of open TV as a means of access to audiovisual content, dissemination of advertising and time dedicated to the day. However, as the adoption of connectivity and the preference for online platforms advances in our country, it is necessary to have a robust, transparent and truthful measurement of the reach, competitive ecosystem and consumption habits of audiences in digital media.

This is the request made by the British government to OFCOM, the regulatory body of communications and media in that country. This, in a context of information asymmetries, notable competitive advantages and lack of regulatory mechanisms in the audiovisual content market that favor digital platforms.

It is worth leveling the playing field between traditional content players and digital content players that today coexist in the same media ecosystem and that serve a growing number of audiences, compete in the offer of advertising space to advertisers and must comply with obligations to avoid improper or anti-competitive practices.

Analysis by Ernesto Piedras of The Competitive Intelligence Unit, The CIU.

Leave your comment