Mexico. Restricted Television and Audio Services (STAR) are defined in the Federal Law on Telecommunications and Broadcasting (LFTR) as those of "associated audio or audio and video telecommunications that are provided to subscribers, through public telecommunications networks, through contract and periodic payment of a pre-established amount".

Mexico. Restricted Television and Audio Services (STAR) are defined in the Federal Law on Telecommunications and Broadcasting (LFTR) as those of "associated audio or audio and video telecommunications that are provided to subscribers, through public telecommunications networks, through contract and periodic payment of a pre-established amount".

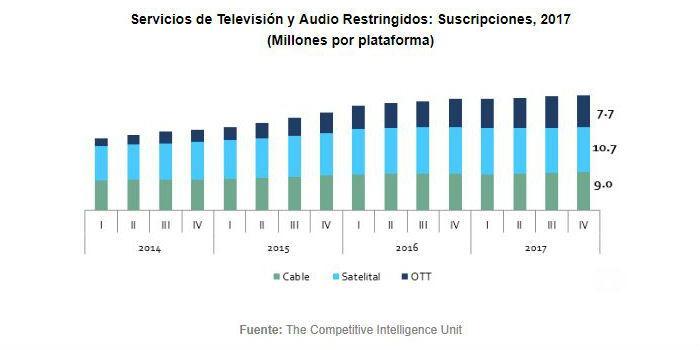

As a result, three platforms for the provision of monthly paid video content compete in the STAR market, namely restricted satellite television, cable television and other technologies (e.g. microwaves) and internet video on demand or Over the Top (OTT) services.

The most recent report by The Competitive Intelligence Unit on the subject, points out that this market is characterized by its accelerated growth in revenue and upward dynamics in its hiring, attributable to the marked preference for the consumption of audiovisual content, especially those transmitted from on-demand and multiplatform platforms (Over-The-Top, OTT), to the packaging with other services (telephony, internet, SVOD platforms and TV Everywhere) and to the launch of affordable offers in terms of prices for households.

The Subscription Market

At the end of 2017, the STAR market accounted for 27.4 million subscriptions, equivalent to an annual growth of 3.3%. The fastest growing segment is OTT, with 7.7 million subscriptions, 15.6% more than in 2016, while the satellite segment (10.7 million) registered a fall of 4.2% before the dissolution of the transitory increase that took place due to the transition to Digital Terrestrial Television in 2016. That of cable and other technologies (9.0 million) registered an increase of 3.5% in an intermediate maturation phase with positive growth rates but lower or constant.

The ubiquitous and on-demand supply of original content has driven the preference for hiring OTT platforms. Another relevant factor is the possibility that several users (2 - 4) can view content simultaneously, from the contracting of a single account or billing plan.

Thus, at the end of 2017, the proportion of OTT subscriptions amounts to a ratio of 28.2% of the total STAR increasingly close to that of restricted cable TV (32.8%), but still distant from satellite TV (39.0%). Under this rate of growth, OTT platforms have captured a volume of users that is quickly approaching those of traditional content distribution platforms.

The Market in Revenue

In terms of revenue, the market totaled $26,082 million pesos during the fourth quarter of 2017, 11.4% more in the year-on-year comparison. In its distribution, it stands out that the weighting of OTT services ($3,314 million pesos) in total revenues is only equal to 12.7%, while in the case of satellite TV it is 28.4% and 58.9% in the case of cable TV.

This is attributable to the fact that the monthly payment for the subscription to an OTT service is even more affordable than the basic prepaid satellite TV packages, and even more so when it is prorated among the number of users of the subscription. In numbers, on average the monthly expense for an OTT account is $140 pesos, while the average price of a basic package is $202 pesos per month.

Under this dynamic and competitive scenario, the strategy of restricted television operators is to try to level the playing field, by implementing convergent content offerings with cross-platform video-on-demand platforms that incorporate content from major content generators.

This is how a 'content war' is witnessed to attract the largest volume of audiences from original/exclusive content or via strategic transmission agreements that provide added value to traditional or previous offers. All this has caused an upward dynamic in both revenue and subscriptions within the STAR market.

Text written by Radamés Camargo, from The Competitive Intelligence Unit.

Leave your comment