Mexico. Restricted Television and Audio Services (STAR) are defined in the Federal Law on Telecommunications and Broadcasting (LFTR) as those of "associated audio or audio and video telecommunications that are provided to subscribers, through public telecommunications networks, through contract and periodic payment of a pre-established amount".

Mexico. Restricted Television and Audio Services (STAR) are defined in the Federal Law on Telecommunications and Broadcasting (LFTR) as those of "associated audio or audio and video telecommunications that are provided to subscribers, through public telecommunications networks, through contract and periodic payment of a pre-established amount".

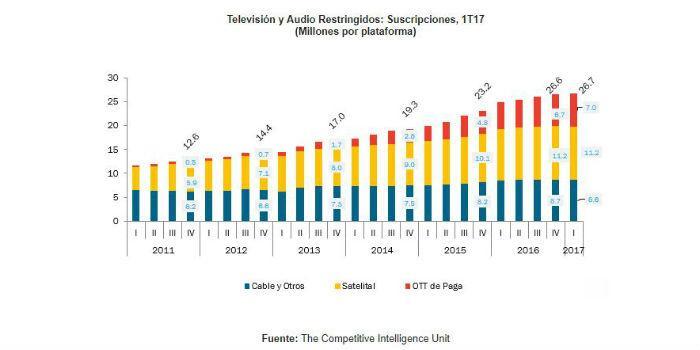

As a result, according to the latest study by The Competitive Intelligence Unit S.C., three platforms for the provision of monthly paid video content compete in the STAR market, namely: restricted satellite television, cable television and other technologies (e.g. microwaves) and internet video-on-demand or Over the Top (OTT) services.

This market has been characterized by its high dynamism and accelerated contracting among consumers, due to various strategies for launching packages at affordable prices in the case of satellite television, packaging with other services (telephony and internet), ubiquity and possibility of multiplatform access as is the case of OTT services and TV Everywhere, among other features.

The Subscription Market

In the first quarter of 2017 (1Q17), the STAR market reached 26.7 million subscriptions, 7.4% more than in the first quarter of 2016 (1Q16). Within this market, it is identified that the fastest growing segment is OTT, with 7.0 million subscriptions and an annual growth coefficient of 24.1%, while in the satellite segment (11.2 million) and in the cable and other technologies segment (8.6 million) there was an increase of 3.7% and 1.1%, in an intermediate maturation phase with positive but decreasing growth rates.

The ubiquitous and on-demand offer of exclusive content has driven the preference for hiring OTT platforms. So in 1Q17, the share of subscriptions to these in the total STAR market reaches 24.3%, which is close to that of restricted cable TV (31.0%), but still distant from that recorded by satellite TV subscriptions (44.7%).

Precisely under this rate of growth, OTT platforms have reached, in just an eighth fraction of the time (just over five years), the same subscription accounting that took the restricted television companies (almost four decades).

The Market in Revenue

In terms of revenue, the market reached $25,920 million pesos, equivalent to a growth of 16.5%. Although a similar dynamism is identified as in subscriptions when comparing the component segments in revenue, in its distribution it stands out that the weighting of OTT services ($2.7 million pesos in 1Q17) in total revenues barely amounts to 10.3%, compared to 59.2% that is registered in the case of satellite TV and 30.5% of cable TV.

This is attributable to the fact that the monthly payment for an OTT subscription is even more affordable than the basic prepaid satellite TV packages. In numbers, on average the monthly payment per OTT is $120 pesos, while the average price of a basic package is $198 pesos per month.

Under this competitive scenario, restricted television operators have implemented strategies to launch video-on-demand platforms that even incorporate content from major content generators, to cope with the supply of OTTs. The forecast going forward is that, supported by this strategy, with a growing offer of access platforms, coupled with the relentless advancement of OTT platforms, this market will continue its dynamic growth trajectory, both in revenue and subscriptions.

Text written by Radames Camargo of The Competitive Intelligence Unit S.C.

Leave your comment