Mexico. As of the third quarter of 2022 (Q3-2022), an adverse macroeconomic environment persists, characterized by buoyant inflation at levels not seen in recent decades, rising interest rates in most regions, the continued Russian invasion of Ukraine, as well as the persistence of the COVID-19 pandemic.

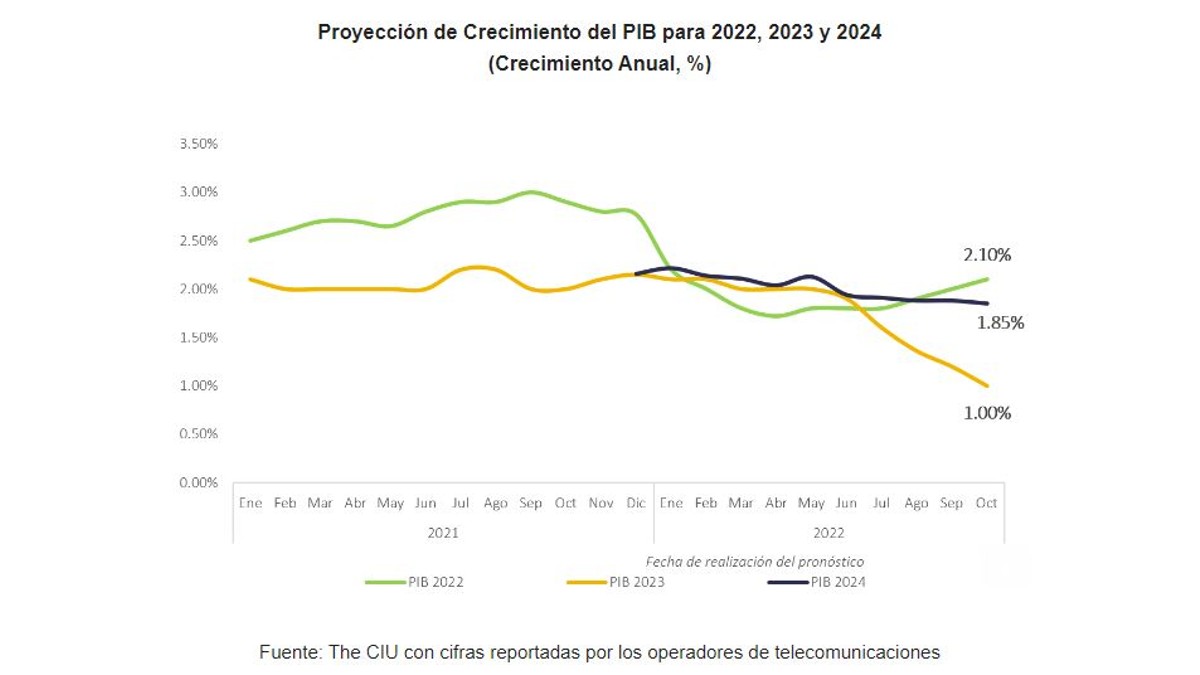

Thus, a slowdown in growth is forecast at the end of the year and even for 2023, both in the world and in our country. The International Monetary Fund (IMF) forecasts a rate of 2.1% for 2022 and 1.2% in 2023, levels that added to the 4.8% rise of the economy in 2021, fail to recover the dynamism registered in 2018.

In contrast, the telecommunications sector in Mexico is expected to continue its usual procyclical trajectory, based on the expansion registered by access and use of services, especially the ubiquitous connectivity that leaves behind the episode of stagnation and even fall in the consumption of telecommunications services registered during the first pandemic years.

Total and Segment Revenue

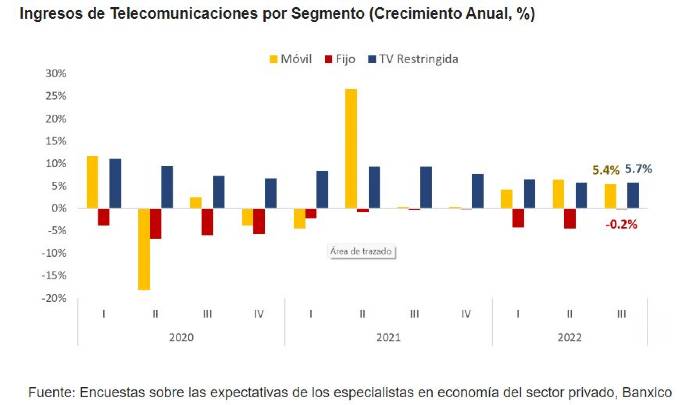

The aggregate of revenues from the provision of telecommunications services generated by operators in the market reached a total of $136.3 billion pesos (mmp), 4.5% more in its annual comparison. This accounting and dynamism resulted in the main dynamic of the mobile market, contributing $79.5 mmp or a ratio approximately 58.4% of the total generated sectorally.

Secondly, due to its positive contribution, the Pay TV and convergent services segment stands out with a revenue figure of $33.4 mmp (24.5% of the total), registering a growth of 5.4% in annual terms.

Secondly, due to its positive contribution, the Pay TV and convergent services segment stands out with a revenue figure of $33.4 mmp (24.5% of the total), registering a growth of 5.4% in annual terms.

Both markets with upward trajectory and growth ratios higher than the sector's dynamism (4.5%) recorded an intensification in the contracting and consumption of mobile and packaging services, respectively. This, being fixed and mobile connectivity and home entertainment essential for Mexicans.

In sharp contrast, there is the provision of fixed services (companies that only provide telephony and broadband) with a slightly downward trend (annual fall of 0.2%), with an accounting of $ 22.3 mmp in revenues and a downward contribution that reaches 17.1%. The growing tariff competitiveness that takes place in the segment, together with the transition of players to other markets or business channels, explain the continuity of the red numbers in this market.

Market Outlook to 2022

Despite the adverse circumstances in the global economy, which impact the national dynamism, the telecommunications sector registers a positive and significant dynamism, from the expansion in contracting in consumption and contracting of services that has precisely driven growth during 2022.

However, the macroeconomic slowdown, the expansion in equipment purchase channels and the decrease in the purchasing power of the population attributable to high inflation, exert a negative weight on the acquisition of smartphones with mobile operators.

Under this scenario, an average growth scenario of 4.2% is estimated during 2022, twice higher than the GDP forecast made by the specialists surveyed by Banco de México (2.1%), contemplating a stability of prices and consumption of services and under a favorable macroeconomic prospect.

However, the greater dynamism of these circumstances can propel the sector to an annual ratio of 4.7%, in its opposite magnitude can cause a low scenario of growth of 3.5% for telecommunications in Mexico, measured in revenues of operators.

Analysis by Radamés Camargo of The Competitive Intelligence Unit, CIU.

Leave your comment