Mexico. Investment in telecommunications is a sine qua non for the development and growth of the sector. Moreover, a fundamental axis for the deployment of infrastructure and technological change necessary for the efficient provision of its services. Therefore, there must be mechanisms for the promotion of this, being the gestation of effective competition one of the most effective.

Mexico. Investment in telecommunications is a sine qua non for the development and growth of the sector. Moreover, a fundamental axis for the deployment of infrastructure and technological change necessary for the efficient provision of its services. Therefore, there must be mechanisms for the promotion of this, being the gestation of effective competition one of the most effective.

In Mexico, in the absence of an optimal scenario for the promotion of competition, there is a sub-exercise of investment in telecommunications.

Only in the last 5 years, there has been little dynamism in investments of the main, incumbent or preponderant operator América Móvil. In the comparison between 2013 and 2017, a reduction of 43.3% in the amount of its investments in the country is identified, going from $34.9 billion pesos (mmp) to only $19.8 mmp.

In contrast, competitors have strongly increased their exercise from $25.9 to $41.7 mmp., that is, a growth of 61.2% in the aforementioned period.

Thus, the growth of sectoral investment is attributable to the amounts exercised by competing operators, for example, by operators such as AT&T and by national companies such as Grupo Televisa and Megacable that seek to consolidate their market positioning through investments. During the years 2013 to 2017, the average annual growth rate of América Móvil was -5.4%, while for Telefónica it was 1.7%, Megacable of 25.3%, Televisa of 26.9% and AT&T of 42.9%.

The investments of the Televisa Group stand out, an operator that made greater capital additions equivalent to $20.0 mmp in 2017, a third of the total of the sector, an amount even higher than $19.8 mmp. exercised by América Móvil.

This dynamic between competitors has drastically modified the reason exerted by the preponderant against its competitors.

Between 2013 and 2017, the preponderant went from contributing 57.5% of the sector's investments to a proportion of 32.2%. These figures indicate a contraction of almost half of the amount previously dedicated to improving and strengthening its infrastructure resources.

In stark contrast, Telefónica managed to increase its weighting by 2.4%, Megacable by 127.9% and Grupo Televisa by 131.3%.

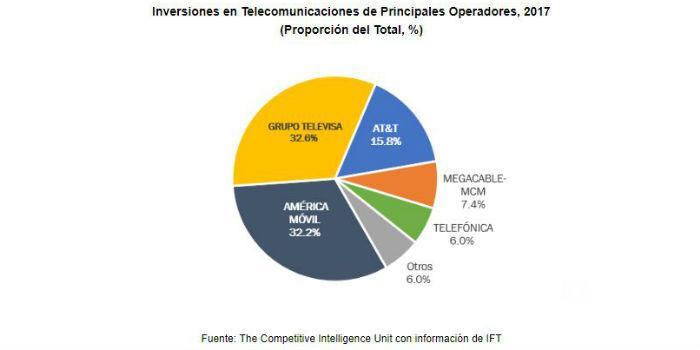

Thus, with information at the end of 2017 (the most recent published by the telecommunications regulator), Grupo Televisa holds 32.6% of the total investments exercised in the telecommunications sector, followed by América Móvil with 32.2%, AT&T 15.8%, Megacable 7.4%, Telefónica 6.0% and the set of other smaller operators 6.0% together.

By comparing the investment amount of traders as a proportion of their income, a sub-investment by the overriding operator is again identified.

In 2017, América Móvil provided services to 57% of the revenue generating units (UGIs) and obtained 58.8% of the total revenues of the sector. However, it only invested 32.2% of the total, equivalent to 7.2% of its income.

In the last 5 years, the Investments/Revenue ratio shows that grupo Televisa led with an average ratio of 38%, while that corresponding to América Móvil accounted for almost a quarter (on average only 11.2% of its revenues). For their part, the rest of the operators show the following coefficients: Megacable 23.3%, AT&T 23.3% (and at the time, its predecessors Iusacell and Nextel).

Moreover, when analyzing the investment made by each line or UGI, it is identified that while the Televisa Group, Megacable and AT&T invested $111.2, $83.6 and $33.4 pesos per UGI on average per month in 2017, respectively, the Preponderant only exercised $11.8 pesos. This is equivalent to a relative underinvestment of $99.5, $71.8 and $21.7 pesos compared to its competitors, respectively.

In the last 5 years, this circumstance has been a constant, such that on average the preponderant has only invested on average $19.9 pesos per month per UGI, while AT&T invested $46.5 pesos, Megacable $59.8 pesos, and Grupo Televisa $84 pesos.

Final Considerations

It highlights the financial effort for the capitalization of competitors. Its objective is to optimize the use of its human, technological and commercial resources.

That is, a case of competition through intensive and sustained investment, while the preponderant has contained its investment amounts as a mechanism of regulatory coercion, which seeks to lighten or even eliminate the pro-competition regulatory burden that applies to it.

This preponderant operator fails to demonstrate that it has effectively complied with the regulation and intends to press for the containment and reduction of its investments.

While competitors such as Grupo Televisa are characterized by strengthening their market footprint in telecommunications, with the exercise of strong and sustained investment amounts, even higher than those of América Móvil, despite registering significant gains in their positioning compared to the rest of the competitors.

As in international experience, the recommendations of regulators and international organizations are to favor the development of the sector based on effective competition and investments in infrastructure for the coverage and injection of cutting-edge technologies.

Leave your comment